Special Edition: Monitoring your superannuation in retirement phase - the top ten performing funds

Retirees cannot compare their retirement phase super fund’s cost or performance using public benchmarking. So today I have sourced you a snapshot of the best performing funds in the retirement phase.

Today I’ve got a special edition of the Epic Retirement Newsletter for you, bringing you some special release data from Chant West on how Australia’s retirement-phase superannuation funds are performing over both 10 years and 1 year. This is data that is not really available in the public at the moment, yet it’s important for those approaching and in retirement to be able to assess how funds are performing after you flip over to the retirement phase.

In this edition:

Article: Monitoring your superannuation in retirement phase: the top ten performing funds

From Bec’s Desk - an exciting little update

Article: How do you find happiness in retirement?

Buy the book or audiobook

Retirees in 2023 are grappling with a peculiar challenge – they cannot compare their super fund’s cost or performance using independent public benchmarking at all.

Superannuation funds in the retirement phase, previously referred to as the pension phase, lack government benchmarks for gauging performance and fees, unlike their counterparts in the accumulation phase who have central benchmarking on MySuper. And this gap makes it difficult for retirees to easily evaluate their retirement phase funds, which is a bit puzzling given that retirement often brings about the most substantial investment returns in one's lifetime. Today, I’m delving into what we do know about the performance of retirement phase funds this year, as well as exploring how you can take a closer look at the performance and cost of your fund if you're in the retirement phase.

We're all striving for a comfortable retirement, and there’s a couple of crucial steps we need to take about once a year, even after retirement, to monitor our superannuation. The first is to keep an eye on the performance of our fund, the second is to monitor the fees being charged by our super fund and the third is to keep checking in on the level of risk and return we want exposure to. These three things are equally important.

But, there's a simple but significant issue at play: once we retire in Australia, it becomes quite tricky to assess how well our super funds are performing or to benchmark the fees they're charging because the only organisations that gather this information are private data companies. Strangely, there are no publicly available benchmarks for this phase. I suspect this will change over time.

So today I have worked with Chant West to get you a snapshot of the best performing funds in the retirement phase, looking at both their one year results for 2023 and the ten year results across two different levels of risk appetite, growth and balanced, the two most common levels of risk people invest at.

Monitoring your retirement phase super performance

Let’s talk about retirement phase super fund performance. Most people don’t realise it, but most of the time funds in the retirement phase actually perform better than funds in the accumulation phase. This is for three big reasons.

First, once you enter the retirement phase, all the income generated by your fund is tax-free, which allows you to get a higher return, and if you reinvest it, will allow your super to have more rapid compounding. Second, depending on your situation, your franking credits are likely to be higher than the tax payable by the fund, again allowing for increased returns each year.

And thirdly, unless your balance is above the transfer balance cap which is currently $1.9M and still held partially in accumulation you will likely have no CGT liability on assets sold in retirement phase.

So on that basis, let’s take a look at the top performing funds in the last year, and the last 10 years in both the growth and the balanced categories.

It’s actually most important to start with the ten year returns, because superannuation is a long term investment, so we really cannot judge a fund on one good year. So below, I have listed the ten year performance of the funds that are categorised as ‘Growth Funds’ and, below it, the funds categorised as ‘Balanced Funds’.

I ran these numbers against some of the corresponding accumulation funds so you could see the difference in performance between the accumulation phase and the retirement phase performance. REST’s Diversified Accumulation fund has delivered a 7.58 per cent return in accumulation and 8.31 per cent in pension phase over 10 years.

Australian Super’s Balanced Fund had a 10-year return of 8.6 per cent in accumulation and 9.48 per cent in pension phase. For both, the retirement phase products are outperforming.

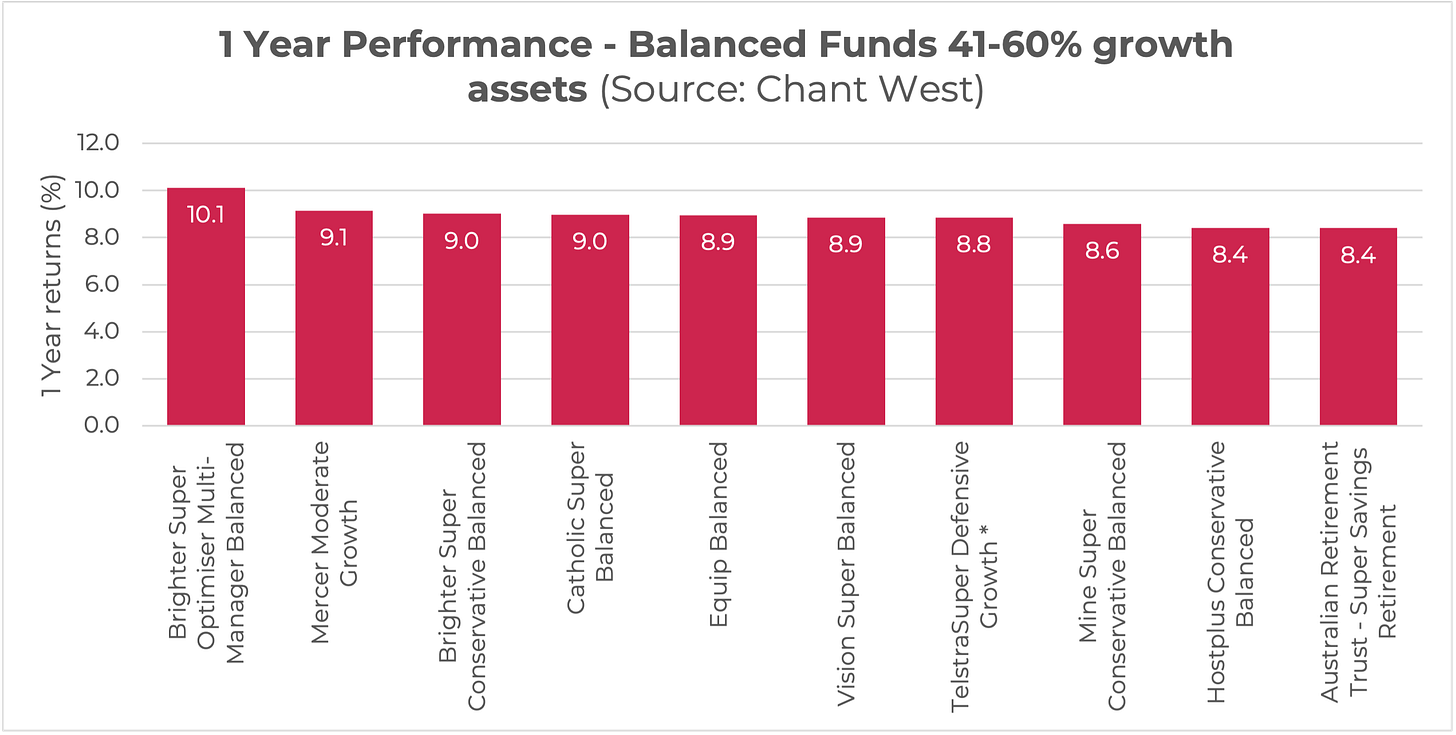

It is also important to keep an eye on which funds are performing well in the last year, which you can see below in the 1 year performance graphs for retirement phase growth funds, and, below that, the balanced funds, which have a lower exposure to growth assets. I would like to warn you against looking at one year data in isolation though because any fund can have one good year.

Consider the fees charged by your retirement phase super funds

Super funds usually report their performance and charges annually. They are required to do so for their default accumulation funds under the MySuper program, which is a benchmark across the industry. They don’t report on their retirement phase products anywhere other than their own websites, which may offer selective information.

It’s important to monitor your fund’s fees, simply because it could be costing you in the long term. A superannuation fund could be yielding high returns for retirees but could still fall short if those returns are offset by higher than average fees. So, it becomes crucial to evaluate the administration costs associated with your chosen fund. To work this out I recommend you add together all administrative fees from your fund and calculate the percentage fee relative to your account balance. By doing so, you can gauge how your fees compare to the norm.

Many funds impose fees as a fixed dollar amount, regardless of your account's size. Generally, as your account balance increases, your fee as a percentage of the total balance should decrease.

Chant West collects data on administration fees for pension phase funds in Australia. Over a decade, they have found that the average fees among the top 10 funds range from 0.1 percent to 0.35 percent based on a $250,000 balance—the current average balance for Australian super funds upon retirement.

Reviewing your risk appetite

As you can see in the data above, I have provided two levels of risk in the benchmarks. I did this because as we get into retirement many peoples’ risk appetite changes, and they go from being keen to enjoy risk and reward, to being a little less keen to have exposure to market downside risk. So I want you to take time as you head into retirement and consider whether you want to be exposed heavily to growth assets, or you might be better with a more balanced approach. There’s no right answer, only your answer, and you might want to talk to a financial planner about it.

So what actions should you take?

So what can you do if you want to take a deeper dive into your retirement phase superannuation’s performance and fees? I’m going to take you back to three essential steps:

Get out your superannuation statement and review the performance of your fund. You can start by comparing against the accumulation benchmarks at the same risk level of risk, to get a broad understanding of whether it is higher or lower. Compare against the ten year returns for balanced funds if yours sits in the balanced category (41-60% growth assets) or the growth category if yours has more growth assets(61-80% growth assets).

Calculate the fee you are being charged on your super as a percentage of your superannuation balance. Explore how this stacks up by looking at the fees charged on accumulation funds by the top ten companies with a similar account balance, and see if yours is on par, lower or much higher.

Consider whether your current risk appetite is suitable for where you are in life and your goals.

If in doubt, get some financial advice either from your super fund or an independent financial adviser.

From Bec’s Desk

The second half of this week has been rather exciting! Yep! We made it to THREE weeks as the number one bestselling self improvement book by an Australian author on Thursday! And today is only one month since the launch of the book!

We did a long show on ABC Radio National ‘Life Matters’ about Relevance Deprivation Syndrome, something I cover at length in the book. The show picked up the personal story of Jim Kilkenny who is featured in How to Have an Epic Retirement, and talks about the impact it has on the sufferers and also their families. You can listen to the show podcast here.

And I also did a really entertaining ABC Sydney and NSW Afternoons radio show with Josh Szeps on Thursday, which you can listen to here. There was so many callers and texts, it was lots of fun to chat with everyone and answer their questions.

This weekend I’ve got a deep dive article in the Sydney Morning Herald and The Age - so make sure you keep an eye out for the money section on Sunday.

And until next week, make it epic!

Bec Wilson Xx

How do you find happiness in retirement?

I went to an inspiring keynote address last night from one of the world leading scientists addressing happiness, Dr Robert Waldinger, the fourth Director of the Harvard Study on Adult Development. This is a study that has been running since 1938, that has evolved over the years to offer some definitive insights into what drives happiness and fulfilment.…

Buy the book, audiobook or ebook

If you haven’t ordered your copy of How to Have an Epic Retirement already, here’s how you can

It is the ultimate guidebook for modern retirees.

How to Have an Epic Retirement guides readers through the way the systems of retirement work, and is packed with tips, insights and guidance that spans six pillars of an epic retirement. It is designed to help you learn the valuable lessons that modern retirees wish someone had shared with them before they kicked off the changes and stages of life that come after retirement.

How to Have an Epic Retirement is on the Hot Picks for Fathers’ Day list for Booktopia. You can buy it 30% off here.

You can also get it on Amazon and Audible here.

Or, you should find it wherever books are sold, in all major bookstores - see the stockists here.

And that’s it for my special edition. Have a lovely weekend. Don’t forget to reach out if you have interesting tales to share with me. Or join the Facebook Group at facebook.com/epicretire.

Hi Bec, great content. I'm all in – glued every week.

Why is there a difference between this data for 10 Year Growth Funds (e.g. HostPlus Balanced 10%, Australian Super Balanced 9.5%, UniSuper Balanced 9.4%) and the data published in "These are the top-performing super funds for retirees" on 3rd Feb 2024 (e.g. Hostplus Balanced 9.2%, Australian Super Balanced 8.8%, UniSuper Balanced 8.6%)? Is it another 6 months data? What am I missing?

Hi Bec, probably a bit late to ask this question, but anyway.... Do the ten-year charts above show "Average Annual Growth Rate" or "Compound Annual Growth Rate"?