Can we use our super to fund our beachside dream? Pros and cons

And in today's newspapers, 'How do you know when you’re ready to retire?'

In this edition

Course: 4 days to go - don’t miss out!

Feature: Letter: Can we use our super to fund our beachside dream? Pros and cons

From Bec’s Desk: Seven out of ten!

SMH/TheAge: How do you know when you’re ready to retire?

Prime Time: How do you know when you’re ready to retire?

Summer Flagship Course starts in four days!

Our Summer Edition of the How to Have an Epic Retirement Flagship Course kicks off Thursday. There’s a 15% discount for those who book before the starting date now.

This is the last course for 2024. We won’t be hosting another until late in Feb 2025.

Want to learn more or download our NEW brochure? ➡️ visit the website here

Or book your place (This link has the 15% off applied)

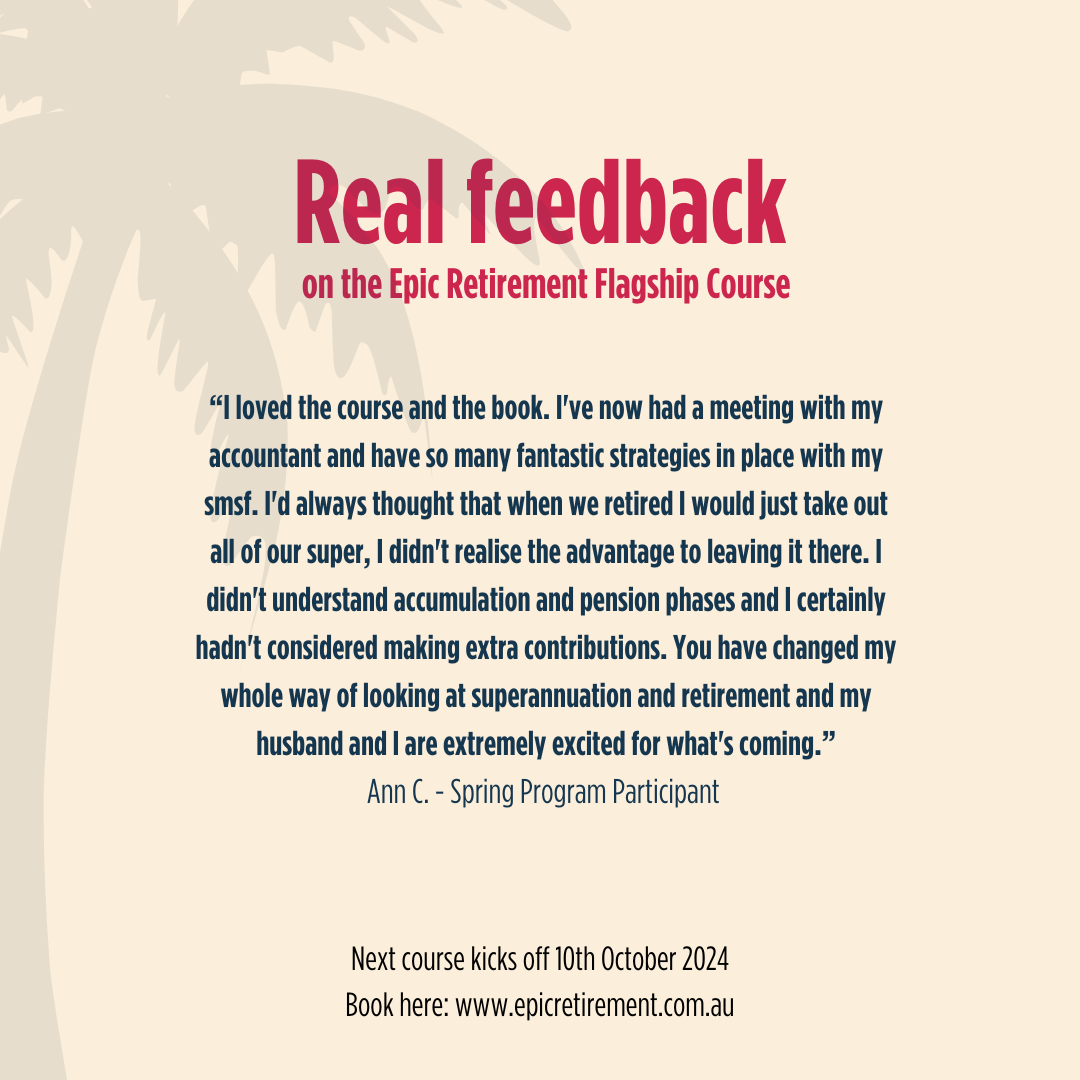

I’ll leave you with one new review from our Spring program today…

Letter: Can we use our super to fund our beachside dream? Pros and cons

Hi Bec,

My husband and I love your book and reading your columns in the SMH.

We have a question for you and think it may be something that many people planning their retirement find confusing.

My husband and I dream of living by the ocean, can we use some of our super to fund our dream to live by the ocean for the first stage of retirement?

Our plan is to use some of our healthy super balance to fund this first stage of retirement. We plan to own this home for 10+ years and then to downsize as we age, at this stage we will use the downsizer contribution incentive and put back up to $600,000 into our super.

We hope that this may mean that we will be eligible for some part pension benefits.

We see retirement as having a few stages to it and while we are healthy and fit we would like to follow some of our life goals. We would love you to help us look into what the pros and cons would be in this scenario.

Thank you, Meagan

Hi Meagan

Thanks for your question! It’s fantastic that you’re thinking about retirement in stages and planning to live out your dream by the ocean while balancing your financial strategy. This is something a lot of people are thinking about, so let’s dive into the pros and cons of a plan like this (remembering I can never give personal financial advice).

Pros:

Living the dream: Using part of your super to enjoy life by the ocean in the early years of retirement is a brilliant way to make the most of your active years.

Phased retirement: Planning your retirement in stages—starting with something like living by the coast - where you achieve your retirement dreams early— and then scaling back as life changes—makes a lot of sense.

Downsizer contribution: After living in the beach house for 10+ years, taking advantage of the downsizer contribution (where you can put up to $300,000 per person back into your super) can help rebuild your super balance later on.

Potential part pension eligibility: Downsizing down the track could free up enough cash to give you a solid income later and if it is balanced carefully, allow you to be eligible for a part Age Pension, which can help stretch your retirement funds further. It’s best to get advice to ensure you have a clear understanding of where the limits are.

Cons:

Dipping into your super early: Pulling money out of your super in the early stages of retirement means there's less left to grow, and super is one of the most tax-effective ways to invest and build your wealth over time. That’s why I’m always super cautious about touching it too soon.

Market and property risks: Your plan banks on your home holding or increasing in value over 10+ years. If property prices dip, you might not release as much equity as you’re hoping when it comes time to downsize. Think about how this would affect your plan.

Cash windfall risk: If you were to sell your home at a price that freed up a lot of capital, it could affect your pension eligibility - scaling back your pension income. It’s worthwhile considering your goals here.

Tying up your assets: Owning property by the ocean ties up a big chunk of your funds in something that isn’t liquid. You’ll need to make sure you’ve still got flexibility in your other investments to generate enough for a comfortable retirement or savings to handle life’s curveballs.

Things to consider:

Higher costs of upkeep: Properties by the ocean tend to have higher maintenance costs—salt air and all that. Make sure to budget for this so it doesn’t become a surprise later.

Keep a super buffer: It’s important to leave enough in super for the long haul. You’ll want to make sure you’ve got enough to generate an income right through your retirement, especially before you downsize.

Age pension and the family home: Remember that your family home is exempt from the age pension assets test - so you’ll want to contemplate how selling that home might in fact free up capital that could throw your goals for the age pension into disarray.

Get financial advice: Before dipping into your super, it’s a good idea to chat with a financial advisor to make sure you’re making the right move for both your lifestyle now and your long-term security.

Your plan sounds exciting!I look forward to hearing about your next chapter!

Cheers - Bec Xx

The countdown is on - just FOUR DAYS until the How to Have an Epic Retirement Flagship Course kicks off - the last one for the year. I’ve signed so many books for this one and they should all be arriving in postboxes any day. The reviews continue to be amazing - thank you to everyone who is enjoying the tail end of Spring and leaving lovely notes. Huge thanks to our speakers - you rock!

It’s all ready to land - we’ve updated everything that changed in the age pension in September - so it’s all fresh and ready to go!

My own mum is going to be doing this course - can you believe! 😀 Ain’t that cool!

—

It’s a bit of a last push to lock in my next book, called Prime Time - I’ve submitted about 7/10ths of it - only a little bit to polish now! I’m feeling calm - excited even! It’s almost done! And as you can see - I’m still preserving my words!

So I won’t go on - I’ll save them for the book! I’m off to celebrate my daughters 21st birthday tonight (writing this Saturday afternoon with a cuppa!) Don’t forget to send me your letters! I love them. Please, send them to bec@epicretirement.com.au.

Many thanks! Bec Wilson

Author, podcast host, columnist, retirement educator, and guest speaker

How do you know when you’re ready to retire?

Extract of article published in print in The Age, The Sydney Morning Herald, Brisbane Times, WA Today on Sunday 6th October 2024.

There’s no magic warning light that comes on in life telling you it’s time to retire, and the templates we used to map our lives to have been broken by increasing longevity – leaving us with no real ‘retirement age’.

Instead, we are limited by how our body, mind and spirit hold together in the second half of our life. That means choosing the right time to retire is in your hands – or, at the very least, it could be, if you are proactive.

The reality is people aren’t proactive enough. Only 31 per cent of people retire by choice in Australia today. The rest are retrenched or retire for one two other reasons – their health declines, forcing them to; or they must care for a loved one whose health is declining. When you don’t choose retirement consciously, it can be much more difficult to adapt to.

When I speak to employers with an older workforce, they want people to be more proactive too. More employers than ever say that they’d like their employees to better understand how to build financial security for retirement in midlife.

Then, they’d like them to contemplate their choices as they reach that financial security that allows them to lean into the good bits of life a little more. They point out that they’d rather not push people who are struggling with cognitive or health issues into redundancy or retirement.

They’d much rather people choose to enter the next stage of their life with goals in place, excited about their plans before their health or cognitive ability declines. So, how do you know when you’re ready to retire?

1. You’ve worked out when you’ll have ‘enough’

Knowing how much money you think is enough for you to retire, or to start stepping back from full-time work is important. Everyone approaching retirement should know their ‘enough number’ – how much they need to retire at the standard of living they are satisfied to live at for the rest of their lives.

Read on, in The Age, The Sydney Morning Herald, Brisbane Times and WA Today.

How do you know when you’re ready to retire?

This week on the Prime Time podcast we’re going to talk about the big, curly question — ‘how do you know when you're ready to retire’? It’s something I get asked all the time. And so this week, Gen Rule, our show’s producer is turning the table and asking me the questions.

LISTEN TO THIS EPISODE OF THE PODCAST HERE:

Last of all, if you haven’t read the book, you can order your copy from Amazon online and Big W online too. Or pick up a copy at your local Big W, or QBD stores.

IMPORTANT DISCLAIMER: The info in this newsletter and everything from Epically and Epic Retirement is here to give you general guidance and spark your learning journey. It’s not personalised financial, investment, or legal advice – just solid, educational content. Things change (hello, laws and regulations!), so it's always a good idea to chat with a qualified financial advisor, accountant, or legal pro before making any big moves. While we aim to bring you accurate and reliable insights, we can’t promise perfection, so use the info at your own discretion. At the end of the day, you’re in the driver’s seat for your financial decisions.

Bec Wilson = 🎠🏐

Hi Bec

I think you should let single people know that $900k in super, gives you the same return as the person with $300k in super + age pension...!