Why the cost of a comfortable retirement has skyrocketed over the past 20 years

And in today's newspapers, 'This new law could transform your retirement, but the clock is ticking'

In this edition

Course: February is here! Book your place now

Feature: Why the cost of a comfortable retirement has skyrocketed over the past 20 years

From Bec’s Desk: The week for lasts

SMH/TheAge: This new law could transform your retirement, but the clock is ticking

Prime Time: Housing, interest rates and the economy for 2025

Autumn Edition of the How to Have an Epic Retirement Flagship Course is Here!

We’re thrilled to announce that bookings are now open for the first course of 2025, the Autumn Edition of our How to Have an Epic Retirement Flagship Course! 🎉

🌟 Early Bird Special: Be among the first 200 to book and enjoy a 25% discount. Spots are filling up fast—our Friday launch was met with an incredible response, and we couldn’t be more excited! 🌟

📖 Want all the details? Check out our brand-new brochure or learn more on our website. ➡️ Visit the website here ➡️ Book now

Here’s what participants from the Summer Edition had to say:

"Excellent course! Recommended to me by a friend for which I am very grateful. I have already embarked on my retirement journey so only regret is that I didn't know about this sooner. However the content of the course was very comprehensive so there is still so much to think about and to work through. I am sure that it will help me to have an 'epic retirement'. :)" Lyn

"Completing this course was very useful to help guide me (and partner) through discussions we had perhaps skirted around before and focused me on topics I was avoiding. Helped us to be a LOT more prepared when going to a financial advisor for personal advice" Monica

And that’s just the beginning! Download the brochure available on the website for more feedback and inspiration.

Why the cost of a comfortable retirement has skyrocketed over the past 20 years

It’s interesting to see just how far we’ve come as a nation here in Australia.

Do you remember life 20 years ago? The iPod was cutting-edge tech, petrol didn’t make us wince at the bowser, and retirement planning felt simpler. Back then, most people’s retirement plans revolved around the Age Pension and defined benefit schemes. They expected to live into their early 80s, not their 90s, and their idea of comfort didn’t include jet-setting, eating out regularly, or upgrading their tech every few years.

Fast forward to today, and retirement is a completely different ballgame. Costs have skyrocketed, lifespans are stretching well into our 90s, and the concept of a “comfortable retirement” has evolved into something much bigger. Now, retirement isn’t just about slowing down—it’s about living. People are entering this phase with travel goals, lifestyle plans, and a hunger to embrace life’s best.

We’ve said goodbye to most defined benefit schemes, but superannuation has stepped up as the main game of retirement savings. Today, we can confidently say Australia’s super system is one of the best in the world.

This week, the team behind the ASFA Retirement Standard—my go-to for explaining retirement costs—released a fascinating then vs now comparison, showing how retirement expenses have shifted since 2004. Spoiler alert: it’s not just inflation driving up costs; expectations have soared too. Today’s retirees want more from retirement.

So what’s changed?

1. We’re living longer

Back in the day, retirement was a 10-15-year phase. Now, it’s 20-30 years or more. That’s brilliant news for ticking off your bucket list but means your savings need to stretch further—sometimes a lot further.

2. Healthcare costs have exploded

With longer lifespans come higher medical bills. Private health insurance has become a must for many retirees, and it’s not cheap. Yes, we’re getting better care, but those extra years come with eye-watering price tags.

3. Lifestyle expectations have shifted significantly

Gone are the days when retirement meant staying close to home and pottering in the garden. These days, retirees want to travel, indulge in great food and wine, and stay connected with the world through tech. "Comfortable" has taken on a whole new meaning.

4. Essentials are most expensive than ever

The basics—like electricity, water, and food—have all skyrocketed.

Electricity is up 150% since 2004.

Medical and hospital services have increased by 112%.

Food prices are up 72%, with fresh produce like fruit and veg leading the charge.

Property rates and water have surged by 106% and 161%, respectively.

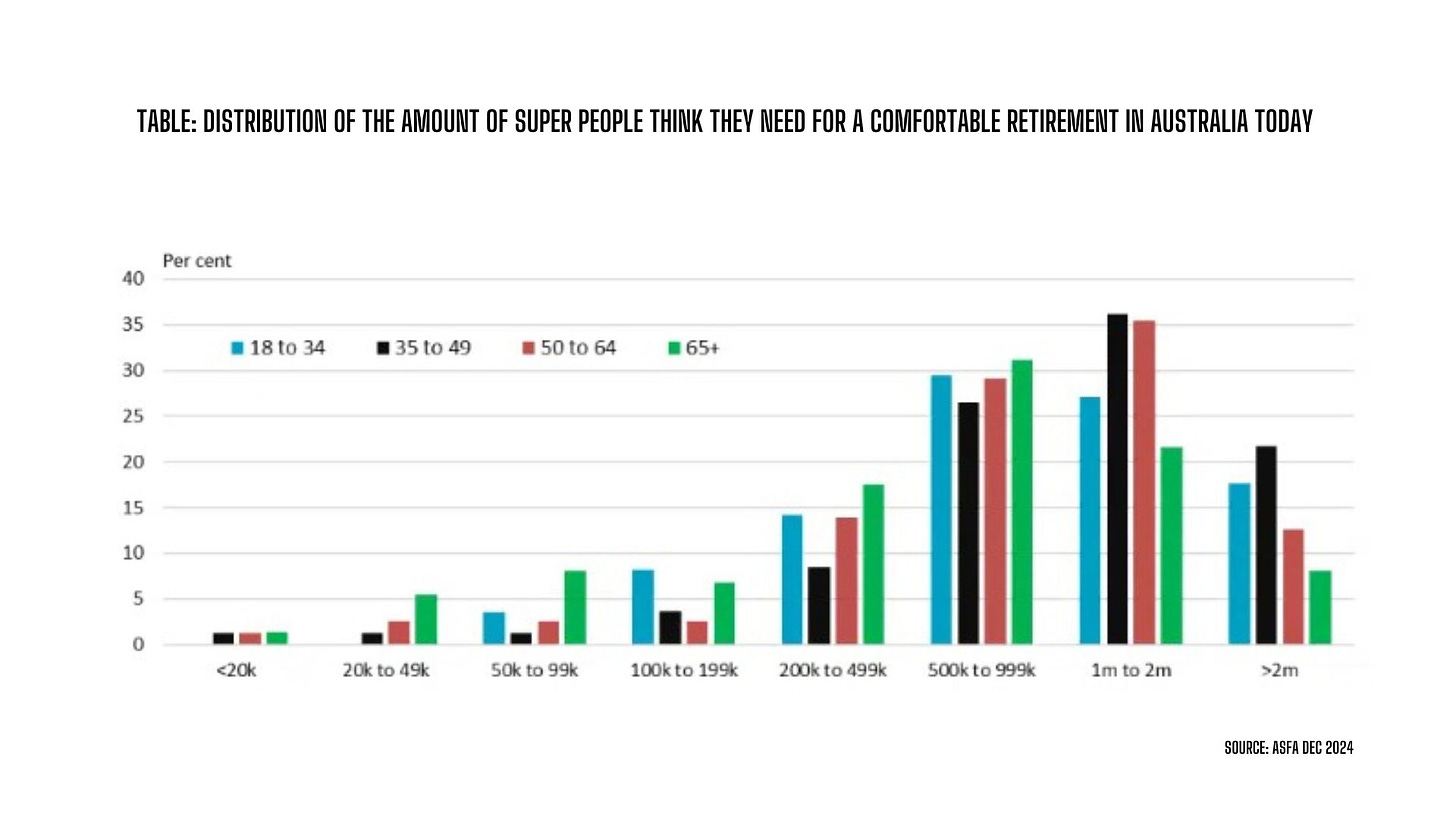

The numbers behind today’s comfortable retirement

In 2024, the retirement landscape is anything but simple. Retirement budgets have jumped by 75% since 2004, with “comfortable” living now requiring:

$73,031 a year for couples.

$51,814 a year for singles.

The reality? Retirement has become a marathon, not a sprint.

The ASFA Retirement Standard now suggests you’ll need:

$690,000 in super for a couple.

$595,000 for a single person.

This assumes you own your home outright and draw down on your super to supplement the Age Pension. If those numbers feel daunting, don’t panic—there are plenty of ways to make your money stretch.

Here’s some good news for the here and now

Let’s end on a positive note: retirement costs actually dropped by 0.5% in the September quarter of 2024. Lower fuel prices and energy rebates helped ease the pressure, and over the past year, retirement budgets rose by just 1.8%—well below the 2.8% inflation rate for the general population.

It’s the week for lasts! In the week just gone I’ve done my last speaking gig for 2024 — speaking to 422 amazing women at the Women in Super Christmas Party in Sydney. This was a buzz. Check out the photos! If you’re in the super industry - keep an eye out for Women in Super — they’re doing amazing things.

I’ve also filed my last newspaper column to The Age and The Sydney Morning Herald editor for the year. You can read it below. It’s inspired by all your letters asking how to navigate the financial advice market.

—

I have to admit, I’m a bit frustrated right now. The book has been flying off the shelves in the lead-up to Christmas, and while that’s amazing, there’s a catch—major retailers don’t tend to reorder books unless they’re recent releases (apparently, this process is now completely automated). That means many stores haven’t restocked, and they won’t know to unless someone asks for it.

So here’s where we’re at: stock is running low everywhere except Amazon. You might still spot a few copies in Dymocks stores, but Big W and QBD look almost completely sold out for now.

It’s definitely a first-world problem to have the book snapped up so quickly, but I totally get how frustrating it must be for anyone trying to grab a copy in-store. On the upside, this might explain why How to Have an Epic Retirement is still hanging out in Amazon’s top sellers!

If you’re keen to get your hands on a copy before Christmas, your best bet is to order it online from Amazon. I appreciate your patience and support—thank you for helping the book find its way into so many hands this holiday season! 💛

I’m selling them signed at shop.becwilson.net too. But you’ll need to order THIS WEEK to beat Australia Post’s last mailing dates.

—

IMPORTANT — I’m putting together a last podcast of the year we’re calling “Bec’s Letterbag” and I need you to send in your letters for it. Send me your questions, your stories about finding your way to an epic retirement and your thoughts on the things you’ve learnt. And get ‘em in fast please - as we need time to record! If you want to ‘record yourself’ as an audio track on your phone - give it a go and send me an audio file we can play on the show. Email me at bec@epicretirement.net.

And have a listen to this week’s pod with Diana Mousina - the deputy Chief Economist of AMP. We talk all things housing market and the economy for 2025 — and she knows her stuff. (below)

—

Like everyone, I’m looking forward to a few weeks with no responsibilities and no deadlines. Bring on December 20! I’m taking most of January off. Phew!

Many thanks! Bec Wilson

Author, podcast host, columnist, retirement educator, and guest speaker

This new law could transform your retirement, but the clock is ticking

Extract of article published in print in The Age, The Sydney Morning Herald, Brisbane Times, WA Today on Sunday 8th December 2024.

The government made a bold announcement this week – one that could become a legacy-defining move for whichever party sees it through.

With bipartisan support, Labor has committed to passing legislation this term that will allow superannuation funds to offer affordable, tailored financial advice for people with less complex needs. It’s a transformative step that could reshape how financial advice is delivered in Australia – but there’s plenty to unpack here for the average person.

A tight deadline and big promises

First, the timing: The federal government has committed to getting this done before the term ends, meaning it must pass during the sitting days starting 6th February – leaving just over a week before the latest possible start of election season.

That’s a tight deadline and a big promise. If they miss it, the legacy falls to the next government.

Many commentators believe the government won’t sit again before an election, which would leave this legislation stranded until midyear, even with bipartisan support – delaying much-needed advice for Australians by another six months.

A transformative change for retirees

Second, the impact: This change has the potential to transform the lives of Australians approaching retirement. If the government can deliver, it will provide the kind of timely support that has long been missing for those navigating this critical stage of life.

This legislation addresses key challenges for both the financial services industry and consumers. Surprisingly, few are discussing just how significant these changes could be, even though behind closed doors, it’s reshaping the advice landscape all over again.

The second tranche of the “Delivering Better Financial Outcomes” package introduces a new class of financial adviser designed to provide simple, affordable advice on products issued by prudentially regulated companies.

Super funds step up

For the first time in a long time, super funds will be able to offer advice to their members—many of whom have relatively straightforward financial needs, such as managing their superannuation investments, their home and mortgage, and their age pension income as part of a cohesive financial plan.

Current laws severely limit super funds in this regard, often leaving members with few options other than seeking independent advisers. These advisers typically provide an initial financial plan and most then offer ongoing portfolio management for a fee through their chosen investment platforms and strategies.

This approach doesn’t always align seamlessly with a member’s existing superannuation setup, often resulting in members moving into more complex, managed investment strategies and platforms that they may not fully understand.

This article continues. Read on, in The Age, The Sydney Morning Herald, Brisbane Times and WA Today.

Housing, interest rates and the economy for 2025

What’s next for the housing market as interest rates fall? In this episode, I chat with Diana Mousina, Deputy Chief Economist at AMP, who shares her expert insights on what 2025 might bring. Together, we explore the Australian housing market, inflation trends, and the future of interest rates.

We dive into the ripple effects of Trump-era tariffs, the challenges ahead for housing affordability, and the outlook for home prices in 2025. Diana sheds light on what’s happening in both urban regional housing markets, the complexities of downsizing, and the opportunities in intergenerational wealth transfer. Plus, she reveals where to look for the best opportunities in property and investment markets in the year ahead.

LISTEN TO THIS EPISODE OF THE PODCAST HERE: