Could grandparents be our biggest financial influencers?

As the use of cash declines we’re going to have to get more creative in how we make money tangible for kids early in life.

It’s Sunday! And I’m on the road in Melbourne enjoying the crisp, sunny, cold weather. I’ll be seeing a few of you at an event in the library at Boroondara in Melbourne on Monday night. It’s completely booked out though so more can’t come I’m sorry!

I’ll also be at the Australians Shareholders Association conference on Tuesday. If you’re there, come and say hi! I love to meet our Primetimers and Epic Retirees in real life.

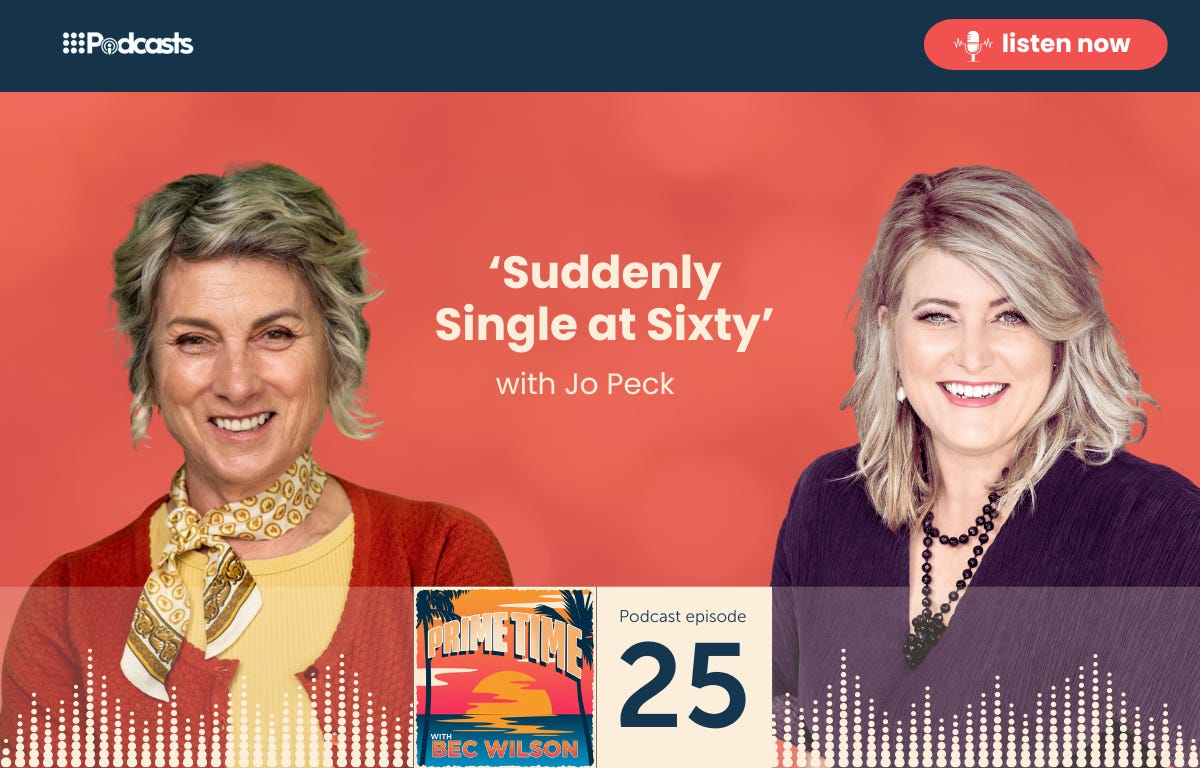

If you missed our awesome Prime Time podcast with Jo Peck on her experience of becoming “Suddenly Single at Sixty” make sure you have a listen. 🎧 Listen on apple podcasts here. Or you can search for ‘Prime time with Bec Wilson’ wherever you get your podcasts.

Finally - the countdown is on to the next six week How to Have an Epic Retirement Flagship Course. The early bird 25% off discount closes ten days before kickoff on the 27th May. So lock in your place so I can send out your book and workbook as soon as they arrive from the publisher. 🎓 Find out more and book your place here.

And that’s it for today. I’m off to be a tourist in this beautiful city of food.

Make it epic!

Many thanks! Bec Wilson

Author, podcast host, columnist, retirement educator, and guest speaker

Could grandparents be our biggest financial influencers?

This article was first published on The Sydney Morning Herald, The Age, WA Today or the Brisbane Times here.

Grandparents play an enormous role in securing their grandkids’ financial future. Plenty of them take their role very seriously too, seeing it as their guiding role to teach their grandkids how money works, and contributing to savings and investments for their grandchildren that can make an enormous difference later in their lives.

My own grandparents were key in shaping my financial literacy, teaching me how to do jobs in their yard and home, making me negotiate a rate for each job, and paying me with little piles of 20 cent and 50 cent pieces that I had to count out and take to the bank.

Using that cash, they taught me about savings, interest, and compounding too. They also taught me how to spend, encouraging me to spend a little of my pocket money, carefully, at the local lolly shop, but not to go overboard.

And they showed me how to be frugal, or careful with money, like they were, by modelling sensible behaviours like shopping for gifts at the sales and tucking them away months before Christmas.

I know now, but I didn’t know then, that in the times when my parents faced financial strain, they quietly supported my education helping my parents juggle those difficult middle years too.

It’s a role more and more grandparents want to play, especially if they’ve got a little more financial certainty than their adult children, but it’s not as easy as it used to be.

With the decline of cash, the ability to make money tangible is harder. Investing on behalf of your grandkids can cause tax issues and grandparents, frankly, aren’t all living frugal lives like mine had to in their generation, so they’re not always modelling the behaviour kids can learn from any more.

So this week, I’ve got some suggestions and lessons for playing that role in your grandchildren’s lives in a much more cashless world.

Teaching kids early in life

As the use of cash declines we’re going to have to get more creative in how we make money tangible for kids early in life.

The fundamentals stay the same – you can help your kids open their first bank account, even become a supervisor on their account alongside their parents, and teach them to use it, the same way my grandparents taught me to use my bank book.

As a supervisor, you can allocate limits for spending and approve money for use. Then, once you have your banking and digital currency tools set up, you can set them jobs they can do, negotiate the rate of payment, teaching them to seek a fair amount, and then pay them diligently once the role has been performed.

Then, you can together set up goals for the savings, allowing a small portion for spending on little joys, and a larger portion for a more strategic goal. You could even be clever, and make one of the rewards an outing to purchase a strategic item together or a trip they need spending money for – a true bonding moment for grandparent and grandchild.

Help build a nest egg

Back in the ’70s, when most grandparents were getting on the property ladder, an average annual wage was about $6300 and the average house price in Sydney was $18,700 – a multiple of about 2.9 times.

The price to wage ratio is now up to 12 times a person’s salary with the average house price in our capital cities now $1,145,000 and the average wage about $90,000 per annum. That means the multiple for a capital city dwelling is something in the league of 12.7 times.

By being a guiding hand with financial literacy, you’re investing in their own future happiness.

Owning your own home is one of the principles of financial security later in life. So, it makes sense that we do whatever we can to help kids to get there as early as possible. The power of compound investing in Australian property has rewarded many and disappointed few. But it’s hard to get started.

Grandparents play an enormous role in securing their grandkids’ financial future. Plenty of them take their role very seriously too, seeing it as their guiding role to teach their grandkids how money works, and contributing to savings and investments for their grandchildren that can make an enormous difference later in their lives.

My own grandparents were key in shaping my financial literacy, teaching me how to do jobs in their yard and home, making me negotiate a rate for each job, and paying me with little piles of 20 cent and 50 cent pieces that I had to count out and take to the bank.

Using that cash, they taught me about savings, interest, and compounding too. They also taught me how to spend, encouraging me to spend a little of my pocket money, carefully, at the local lolly shop, but not to go overboard.

And they showed me how to be frugal, or careful with money, like they were, by modelling sensible behaviours like shopping for gifts at the sales and tucking them away months before Christmas.

I know now, but I didn’t know then, that in the times when my parents faced financial strain, they quietly supported my education helping my parents juggle those difficult middle years too.

It’s a role more and more grandparents want to play, especially if they’ve got a little more financial certainty than their adult children, but it’s not as easy as it used to be.

With the decline of cash, the ability to make money tangible is harder. Investing on behalf of your grandkids can cause tax issues and grandparents, frankly, aren’t all living frugal lives like mine had to in their generation, so they’re not always modelling the behaviour kids can learn from any more.

So this week, I’ve got some suggestions and lessons for playing that role in your grandchildren’s lives in a much more cashless world.

Teaching kids early in life

As the use of cash declines we’re going to have to get more creative in how we make money tangible for kids early in life.

The fundamentals stay the same – you can help your kids open their first bank account, even become a supervisor on their account alongside their parents, and teach them to use it, the same way my grandparents taught me to use my bank book.

As a supervisor, you can allocate limits for spending and approve money for use. Then, once you have your banking and digital currency tools set up, you can set them jobs they can do, negotiate the rate of payment, teaching them to seek a fair amount, and then pay them diligently once the role has been performed.

Then, you can together set up goals for the savings, allowing a small portion for spending on little joys, and a larger portion for a more strategic goal. You could even be clever, and make one of the rewards an outing to purchase a strategic item together or a trip they need spending money for – a true bonding moment for grandparent and grandchild.

Help build a nest egg

Back in the ’70s, when most grandparents were getting on the property ladder, an average annual wage was about $6300 and the average house price in Sydney was $18,700 – a multiple of about 2.9 times.

The price to wage ratio is now up to 12 times a person’s salary with the average house price in our capital cities now $1,145,000 and the average wage about $90,000 per annum. That means the multiple for a capital city dwelling is something in the league of 12.7 times.

By being a guiding hand with financial literacy, you’re investing in their own future happiness.

Owning your own home is one of the principles of financial security later in life. So, it makes sense that we do whatever we can to help kids to get there as early as possible. The power of compound investing in Australian property has rewarded many and disappointed few. But it’s hard to get started.

Some sources say it can take a young couple or a single person today between six and 12 years to save the deposit for their first home if they are saving about 25 per cent of their income a month to aim for a target of a 20 per cent home deposit.

This is where grandparents are playing a powerful role, setting up carefully constructed investment assets and contributing to them early in a child’s life. The objective is to make an investment that can, over the 20-30 years before a child matures and wants their own home, really be left untouched to grow or added to over time, and can offer them a valuable start in life.

However, grandparents who are saving for their grandchildren under 18 years of age need to be aware of the tax implications which can be complicated depending on your personal circumstance and the child’s.

You may find, after talking to an accountant, that it’s better to consider a growth asset than an income strategy, as income tax laws are designed to limit the amount of money a minor can earn from dividends and interest and other passive sources to avoid adults diverting income to their children’s accounts.

And, if setting up a bank account, you’ll also want to get a tax file number in the child’s name to avoid the bank withholding tax unnecessarily, something that is often forgotten or overlooked.

Teaching kids how to spend money

This is a really tough one for many of today’s retirees who are in the midst of the best years of their lives, spending with a greater sense of excitement than the silent generation ever did.

This article continues. Read it on the Sydney Morning Herald, The Age, WA Today or the Brisbane Times here.

Read my article from last weekend that went a little crazy: Cash is dead. Why are we still pretending it isn’t?

This week we’ve dropped two episodes at the same time. A ripper of a podcast with author Jo Peck and in a bonus edition of the podcast, a very focussed and rapid-fire update on what’s in the 2024 Federal Budget for Prime Timers. All the info is below. Have a listen and leave us a rating and a review.

Suddenly Single at Sixty with Jo Peck

In this episode, I speak with Jo Peck, author of the candid memoir, 'Suddenly Single at Sixty'. It’s a ripper of a conversation and a true story.

Not long after Jo's 60th birthday, her husband drops a bombshell—he’s leaving her for a (much) younger woman. Jo is shocked and heartbroken that the life she’d worked towards, has gone up in smoke. All those dreams of growing old with the person she loved … destroyed.

In this interview, Jo details the journey of personal growth which led to her rebuilding her life, making it clear that life does NOT end at 60.