How to spread happiness in retirement

Are you a bucket filler or a bucket dipper? Is it affecting your happiness and the happiness of the people around you? Plus - a two in one letter on the pension and finding work you 'don't hate'.

In this week’s edition

How to spread happiness in retirement.

Letter: A two in one letter from Rob: Should I leverage the age pension? How do I find work I don’t hate?

From Bec’s Desk

How to spread happiness in retirement

Are you a bucket filler or a bucket dipper? Is it affecting your happiness and the happiness of the people around you?

My daughter is teaching 3 and 4 year olds how to ski on the mountains of Canada. She is having extraordinary success, simply by being great at telling really relatable stories to the little kids, and engaging with them on their level. One of the stories she told the children this week had them all enraptured for days. It was based on a book called “Have you filled a bucket today?” By Carol McCloud. Sometimes kids books offer us simpler ways of looking at life.

I think we should be able to use the bucket filler theory in this stage of life too.

Retirement is a very easy stage of life to become isolated or lacking in confidence, or even a bit negative. It causes people to retract their circle of connection - a cycle we need to feel support breaking out of.

So, I want to extrapolate the same story for our Epic Retirement phase of life and give you some strategies. I want to ask you to consider whether you are a bucket filler or a bucket dipper, and if you’re the latter - how you can turn that around for your own and everyone elses’ benefit. It’s a perfectly timed lesson to release on Valentines Day I think - a day when we all want to feel warmth, even if we aren’t giving or getting a cheesy valentine’s gift.

Here's a snippet from the book:

“All day long, everyone in the whole wide world walks around carrying an invisible bucket”...

“Its purpose is to hold your good thoughts and feelings about yourself.”

“You feel happy and good when your bucket is full”

“You feel very sad and lonely when your bucket is empty.”

“And this is how it works… you need other people to fill your bucket and other people need you to fill theirs.”

“You fill a bucket when you show love to someone, when you say or do something kind, or even when you give someone a smile.”

“That’s being a bucket filler”....

The book goes on….

“But you can also dip into a bucket and take out some good feelings. You dip into a bucket when you make fun of someone, when you say or do mean things or you ignore someone.”

“That’s being a bucket dipper”.

The story reminds us that generosity and kindness in our relationships is important. That leading with true kindness can make others feel good. And that when you fill up someone else's bucket, it also makes you feel good.

And it’s more important than ever in retirement. The science shows, in a more longitudinal way, that our friendships are crucial in this next stage of our life, if we want to live longer healthier lives. But too often they are pushed away because of a lack of effort. We forget that everyone needs a splash of kindness and we forget the enormous sense of personal joy that it brings the bucket filler too.

The power of strong relationships are well recognised in the science of modern ageing. According to the Harvard study of Adult Development, a study of more than 720 men and their families, run over 80 years, it was concluded that the warmth of our relationships and our ability to form close, supportive connections can have a significant impact on physical health, mental health, and overall life satisfaction.

Today, to celebrate Valentines’ week, and demonstrate what it means to be a ‘bucket filler’ my daughter took her little class of enthusiastic 3 and 4 year olds out onto the mountain, with a bag full of mini boxes of smarties and mini kit kats. They skied on their lessons to everyone on the mountain who does a seemingly un-rewarding job and “filled up peoples’ buckets’ by handing them out a lolly and saying a heartfelt thanks. The kids came away even more enraptured at how good they felt when they made other people feel good.

It made me smile at just how easy it is.

But also how bloody easy it is to forget this wonderful lesson in the everyday throes of life as we get older.

So how can we push this warm little lesson into our own worlds of pre and post retirement?

Being a "bucket filler" in retirement (or any other time of life frankly) involves incorporating acts of kindness, connection, and positivity into your daily life. Here are some ideas to help you fill not only your own bucket but also the buckets of those around you:

Make special moments for your partner or loved ones

Does life become ho-hum simply because noone in your home is filling buckets anymore? Take the time to reconnect with your nearest and dearest and make sure they know how much they mean to you. Small gestures, sincere compliments, and acts of kindness create a ripple effect, transforming the dynamics of your connection - really.

Look for volunteering opportunities

Do you engage in volunteer work or community service activities? Do you share your skills and experience to make a positive impact in your community? Maybe you could? There’s no doubt this will contribute to your sense of purpose and fulfilment. It will also help others who are in need too, filling multiple buckets with joy.

Share your wisdom

Have you ever offered to mentor or provide guidance to people younger or less wise than you? To people seeking advice or insight in an area you know plenty about? Sharing your knowledge can be incredibly rewarding - for both you and your mentee.

Create or join a social group

Establish or join a social club or group centred around shared interests. This could be a book club, gardening group, or any hobby you enjoy. Creating social connections enhances well-being for everyone involved. It fills up your bucket and the buckets of many others who enjoy the activities and joys of participating. You don’t have to be the leader to benefit either.

Perform random acts of kindness

Take a leaf out of the childrens’ book and embrace the beauty of small gestures. Surprise your neighbours, friends or family members with a thoughtful note, bake cookies, buy flowers, or simply offer a helping hand when someone needs it. Don’t wait to be asked - people just don’t seem to ask anymore. And certainly, no one rocks up like my grandparents used to teach me to as a child, with a home-picked posy of garden flowers. But what a joy it would be if they did.

Actively connect with your family and friends

Has it been a while since you had an eye-to-eye conversation with a loved one? Reach out and ask them for one, by messenger, zoom, teams or whatever system you need to use if you can’t sit in the same room. Share your time, kindness and love by giving of it freely. Go out of your way to make lasting family connections, and share in the little joys together. Active is a much better state than passive.

Support local businesses

Be a patron to local businesses and contribute to the vibrancy of your community. Whether it's a local café, bookstore, or farmer's market, I’m sure you know already, that your support can make a huge difference - especially in this tough economy.

Organise social activities

Take the initiative to organise social events within your friends, local community or club. This could be a potluck dinner, game night, or any gathering that fosters a sense of camaraderie.

Express your gratitude

And finally, practice gratitude by regularly expressing appreciation for the people, experiences, and moments that bring joy to your life. A simple "thank you" can go a long way in filling someone's bucket.

Remember, being a bucket filler is about creating a positive and uplifting environment for you and for others. Having a courageous and positive attitude to other people is so important as we approach this stage of life. So dig in and find that little child inside you and let’s fill up some buckets, including your own. Happiness is crucial in this stage of life - go looking for it.

This letter is a two-in-one

Hi Bec, Thanks for including me on your mailout. Very interesting reading. I am curious about the attitude toward receiving a pension and what constitutes a sustainable super balance.

I have done some reading on retirement and spoken to financial advisers. It seems that most literature and advice is around avoiding the pension at all costs. I am unsure whether this is just a financial advisor scare tactic to make people think their advice is needed, or whether there is truth in pursuing the goal of being self funded in retirement.

As far as I am aware most people will not be able to accumulate over the pension cut off amount of just over a million dollars in assets. As such, most people will have to receive some pension. (Is this true? Are there any numbers on this?) But if you see a financial advisor, or read any book on retirement, the advice seems to be to work as hard as possible and pile as much into super to avoid the government and the risk of running out of funds.

To me this is insanity. Most people hate working, or hate doing what they have to do. The goal of retiring is mostly about being in a position to stop working but also to be able to do what you want. If that means being able to stop when you reach a condition of release and retire early by accessing your super then so be it. The subsequent top up in your income from a pension is just a bonus.

We all recently experienced going through COVID. One thing that I realized in that period was how little you actually need to live on. For the first time in my life the government sent me money because my business could not earn anything. In that period I also realised I reached an age to notionally retire, and I had a reasonable balance in my super account, so I did. I have only worked sporadically for the past three years. I might add that I hate my job. I hate the people and I hate doing anything for the sector I work in. I would like to keep working at something else but just don’t know what.

The upshot is that I am all but retired several years before being entitled to the pension. I am living off the interest and some of the balance of my super. It is a bit dull at times but I rationalise it as being far better than working at something I hate.

So, I am curious, whether most people aim for self funded retirement and, if so, why? Why is the pension so stigmatized by financial advisors and media? How much superannuation do most people accumulate and can there be that many people with over a million in super? Regards, Rob

Hi Rob,

What an interesting letter. I have to suggest that you read my book to better understand the age pension, and also to explore your own happiness and fulfilment. I offer a number of model financial scenarios that show how people can achieve a comfortable or a modest retirement, explaining a little more about how the pensions plays into it, and what capital is conceptually required.

Let’s start with my views on the pension. I absolutely believe you should, if you’re an ordinary Australian with an average-ish super balance (~$150-500k), learn to balance and layer multiple income streams, one of which is the age pension. It is nothing to be afraid of. In fact it’s a marvellous system, supporting the income of more than 62 percent of Australians over the age of 67. So whatever you’re being told to the contrary should be re-explored. And, if you don’t qualify today, and you are currently self-funded, with around $1M in assets other than your home, you might well qualify in the future, depending on how much you spend and how your investments perform in the years ahead. You should take the time to develop an understanding of the assets and income tests, which I explain in the book and explore whether getting the age pension is something you want to aim for or fall back on. You should also explore the Commonwealth Seniors Health Card - as you will likely qualify for some good health benefits if you are ineligible for the pension. Its income test thresholds are quite high, and the assets test doesn’t apply. Note, if you do access the age pension, you can still earn $11,800 per calendar year from working, without your pension reducing. It’s called the Work Bonus. It’s another way the government encourages layering of income, and for many people, that $11,800 can be the difference between living in comfort and living modestly.

I should warn you - I’m not a financial adviser. So, your own financial situation is not something I can speak directly to, and I do believe good financial advice is valuable. Maybe you just haven’t found an adviser you can trust and rely on, who understands your goals and objectives - an important part of the process of getting advice - also covered in my book.

Next let’s address your frustrations from work: I feel for you. Working on something you enjoy can be so fulfilling that it can even lengthen your life, but working on things you don’t enjoy, with people who you don’t relate to is stifling.

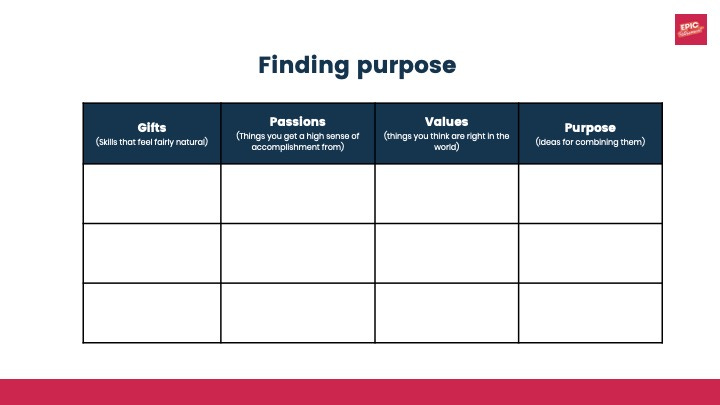

I encourage you to do some self examination - to explore what it is that you’re passionate about, and to develop work (or charitable acitivites) in areas where your interests lie. Here’s a little table I suggest people use to do a bit of self enquiry to explore where their skills and passions collide - often a great place to start looking for work. And the upside - people who are passionate about similar things, often find things in common - and may even get on quite well, adding to the social rewards of working. I hope this helps. Remember, ‘work’ doesnt have to be paid! It can be charitable too.

INSTRUCTIONS:

Just take out a piece of paper like this and create four columns, or print this out.

Write down all the skills that you have, and the things that you do in life rather naturally and with joy. They may be skills you have fallen out of the habit of using, or they may be skills you use regularly.

Then, consider your passions - the issues, concerns or things in the world that you feel a passion about - and that you get a high sense of accomplishment from.

And then think about your values and beliefs - and write them down - your anchor points in right and wrong.

Now, imagine what you can do that brings all three together - this is where you should start looking, exploring for opportunities.

I’ve spent my morning sitting quietly in a breastscreen clinic. Yep - I got my first breastscreen last month after writing for a long time to everyone about getting ALL your prevention tests. This was the last one on my list that I hadn’t done. And after my first scan I got a callback - apparently very common. So I brought my 6 hours of activities and snacks to the waiting room in the more central Brisbane Breastscreen office as suggested, and I got this newsletter finished, in between scan, ultrasound and multiple doctors visits. The waiting room was packed with women, all there for a callback to see the specialist and to rotate their way through waves of scans and tests, all sitting patiently. There wasn’t a spare seat in the two large waiting rooms. Most, if not all were older than me. I wonder how many of these women will actually find signs of cancer today. Ain’t that a tough reality.

If you haven’t had a breastscreen and you are over 50, or your doctor deems you have elevated risk in your 40s, go do it. It’s an impressive operation designed to prevent us from dying of breast cancer much earlier in life. It’s one of those reasons that the baby boomer generation is living nearly 20 years longer than their parents’ generation. And one I urge you all to take advantage of. We can catch breast cancer early! PS. I got the all clear - so I can go home.

What else has been happenin’ this week?

Hold your breath! Another short delay for season two’s release of the Prime Time podcast - but it’s worth it. Season two is being recorded and edited as we speak. It’s set to bring you a really interesting diversity of topics! And, some special sponsors are locking in, supporting what we do too! That part is really important - makes what I do able to be free for all to enjoy and will lead to the show becoming more widespread. So we can reach more people as they approach retirement and inform more about how to leverage the best of their Prime Time and prepare for an epic retirement.

I have a new and helpful friend in our epic retirement community. William has kindly volunteered to edit my newsletter for typos. So we all have him to thank for the reduction in little errors 🥰. Thanks William! It fills my bucket!

I love ABC Radio. This week I’ve chatted on ABC Southern Queensland Drive with Annie Gaffney all about working in retirement. I also chatted yesterday on the Gold Coast Drive with Julie Clift on what to do in your 50s and 60s as you prepare for retirement. I hope you’ve been listening along.

My article in the Sydney Morning Herald and The Age this week got quite a few people writing me letters. So did the letters in the email that accompanied it. Crackers!

And finally - I have a poll for you. This one is a touchy one. But it’s important to hear your thoughts. I’m grateful for your support and appreciation of what I do. And I love doing it.

And finally, your letters… I really am loving them. And we’re going to include them in the Prime Time podcast too. Just email me at bec@epicretirement.com.au. Remember I’m not a financial adviser but I won’t hesitate to answer about a common problem on a general basis - if there is an answer!

Have a great week ahead, and make it epic!

Many thanks! Bec Wilson

Author, podcast host, columnist, retirement educator, and guest speaker