Letter: Frustrations from the workplace and 'should I really be avoiding the pension at all cost?'

I encourage you to do some self examination - to explore what it is that you’re passionate about.

This letter is a two-in-one

Hi Bec, Thanks for including me on your mailout. Very interesting reading. I am curious about the attitude toward receiving a pension and what constitutes a sustainable super balance.

I have done some reading on retirement and spoken to financial advisers. It seems that most literature and advice is around avoiding the pension at all costs. I am unsure whether this is just a financial advisor scare tactic to make people think their advice is needed, or whether there is truth in pursuing the goal of being self funded in retirement.

As far as I am aware most people will not be able to accumulate over the pension cut off amount of just over a million dollars in assets. As such, most people will have to receive some pension. (Is this true? Are there any numbers on this?) But if you see a financial advisor, or read any book on retirement, the advice seems to be to work as hard as possible and pile as much into super to avoid the government and the risk of running out of funds.

To me this is insanity. Most people hate working, or hate doing what they have to do. The goal of retiring is mostly about being in a position to stop working but also to be able to do what you want. If that means being able to stop when you reach a condition of release and retire early by accessing your super then so be it. The subsequent top up in your income from a pension is just a bonus.

We all recently experienced going through COVID. One thing that I realized in that period was how little you actually need to live on. For the first time in my life the government sent me money because my business could not earn anything. In that period I also realised I reached an age to notionally retire, and I had a reasonable balance in my super account, so I did. I have only worked sporadically for the past three years. I might add that I hate my job. I hate the people and I hate doing anything for the sector I work in. I would like to keep working at something else but just don’t know what.

The upshot is that I am all but retired several years before being entitled to the pension. I am living off the interest and some of the balance of my super. It is a bit dull at times but I rationalise it as being far better than working at something I hate.

So, I am curious, whether most people aim for self funded retirement and, if so, why? Why is the pension so stigmatized by financial advisors and media? How much superannuation do most people accumulate and can there be that many people with over a million in super? Regards, Rob

Hi Rob,

What an interesting letter. I have to suggest that you read my book to better understand the age pension, and also to explore your own happiness and fulfilment. I offer a number of model financial scenarios that show how people can achieve a comfortable or a modest retirement, explaining a little more about how the pensions plays into it, and what capital is conceptually required.

Let’s start with my views on the pension. I absolutely believe you should, if you’re an ordinary Australian with an average-ish super balance (~$150-500k), learn to balance and layer multiple income streams, one of which is the age pension. It is nothing to be afraid of. In fact it’s a marvellous system, supporting the income of more than 62 percent of Australians over the age of 67. So whatever you’re being told to the contrary should be re-explored. And, if you don’t qualify today, and you are currently self-funded, with around $1M in assets other than your home, you might well qualify in the future, depending on how much you spend and how your investments perform in the years ahead. You should take the time to develop an understanding of the assets and income tests, which I explain in the book and explore whether getting the age pension is something you want to aim for or fall back on. You should also explore the Commonwealth Seniors Health Card - as you will likely qualify for some good health benefits if you are ineligible for the pension. Its income test thresholds are quite high, and the assets test doesn’t apply. Note, if you do access the age pension, you can still earn $11,800 per calendar year from working, without your pension reducing. It’s called the Work Bonus. It’s another way the government encourages layering of income, and for many people, that $11,800 can be the difference between living in comfort and living modestly.

I should warn you - I’m not a financial adviser. So, your own financial situation is not something I can speak directly to, and I do believe good financial advice is valuable. Maybe you just haven’t found an adviser you can trust and rely on, who understands your goals and objectives - an important part of the process of getting advice - also covered in my book.

Next let’s address your frustrations from work: I feel for you. Working on something you enjoy can be so fulfilling that it can even lengthen your life, but working on things you don’t enjoy, with people who you don’t relate to is stifling.

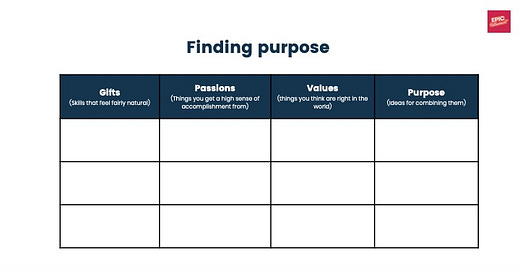

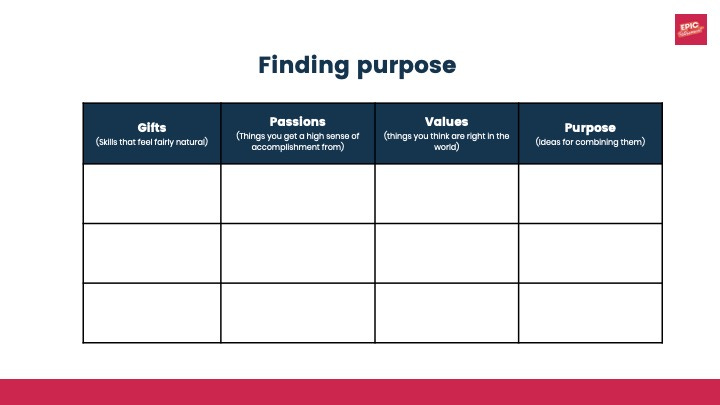

I encourage you to do some self examination - to explore what it is that you’re passionate about, and to develop work (or charitable acitivites) in areas where your interests lie. Here’s a little table I suggest people use to do a bit of self enquiry to explore where their skills and passions collide - often a great place to start looking for work. And the upside - people who are passionate about similar things, often find things in common - and may even get on quite well, adding to the social rewards of working. I hope this helps. Remember, ‘work’ doesnt have to be paid! It can be charitable too.

INSTRUCTIONS:

Just take out a piece of paper like this and create four columns, or print this out.

Write down all the skills that you have, and the things that you do in life rather naturally and with joy. They may be skills you have fallen out of the habit of using, or they may be skills you use regularly.

Then, consider your passions - the issues, concerns or things in the world that you feel a passion about - and that you get a high sense of accomplishment from.

And then think about your values and beliefs - and write them down - your anchor points in right and wrong.

Now, imagine what you can do that brings all three together - this is where you should start looking, exploring for opportunities.