Pension payrise: Pension thresholds, deeming and income free areas rise

Around 62% of people in retirement get some form of pension so these changes commencing 1 July 2023 will impact many.

In positive news, the Australian government has announced they will increase age pension thresholds and income free areas on 1 July 2023 to allow for inflation, effectively increasing eligibility for the pension across the country. And that is good news for more than 62% of Australians who access pension income in some form in this country.

The pension amounts don’t change directly, but the amounts you receive in your account if you’re a part pensioner will, as will the number of people who can get a full pension. This is because of an increase to the asset and income floors which define a full pension, and the caps at which you lose access to the pension. They’ve also adjusted the bands for deeming, one of the key measures of the income test. This will again see more people able to access a full pension, and more people able to get access to part pension and the highly coveted pension concessions and concession card.

From July 1 we will see the assets test floors that allow people to draw a full pension increase.

We will also see the ceiling on the assets test rise, allowing more people to access a part pension and the pension concessions associated.

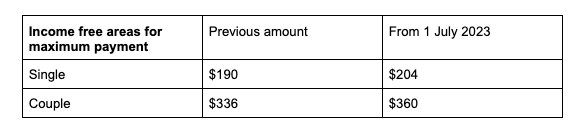

At the same time, there has been indexation to the income test floors and ceilings, allowing you to earn a little more in a fortnight in your deemed and actual income without losing your pension payments.

The amount you can spend on an exempt funeral investment or funeral bond has increased too, moving from $14,000 to $15,000 to reflect inflation.

And finally, the government promised last year that they would not make any changes to deeming rates until 1 July 2024, but they have added a nice little bonus, changing the deeming thresholds, which will give you a shift in how your assets are evaluated in the income test, effectively increasing the amount you can earn from financial assets. This change is actually rather significant. This is an increase to the amount that you apply the deeming rate of 0.25% to when you calculate your deemed income from financial assets.

The financial effect all these changes could have on your pension should be beneficial to everyone and result in an increase to the amount you earn. It really depends on which test you qualify for the pension as to how much you will see in your bank account after 1 July. It is likely that part pensioners will get a little more from this than full pensioners, simply because the taper rates will kick in at higher levels.

You can read all about how the age pension, and its assets and income tests work, and how you can optimise your eligibility in my upcoming book, How to Have an Epic Retirement, now available for pre-order.

There’s plenty more in the newsletter below. Do pop on over to the website and leave me your comments and feedback. And please, share this with a friend and let’s grow the community of epic retirees.

*** important note: We start ‘retirement diaries’ stories in the next couple of weeks and I’m looking for people who want to tell their retirement stories to me so others can learn from and enjoy them. Email me on bec@epicretirement.com.au if you’re keen.

So until next week - make it epic!

Bec Wilson Xx

How to manage retirement with a low super balance

This column appeared in both print and digital in the Sun Herald and Sunday Age. You can read it here.

Last week, my article on how much retirees live on in Australia sparked dismay and concern. This is because the median superannuation balance among over-65s right now is firmly below the level that the Australia Superannuation Funds Association (ASFA) declares as able to provide for a “comfortable” retirement. And the pension, well, it’s not enough to get by on, particularly if you have to pay rent. Less affluent retirees face a tough reality in this cost-of-living crisis.

So this week, let’s delve into how someone with the current median Australian super balance for individuals aged 65-69 can make ends meet and achieve a comfortable retirement and aim for a few great experiences too.

Read more on the Sydney Morning Herald website here.

How to Have an Epic Retirement is now available for pre-order

I’m pleased to say that my book is now at the printers and if you’ve pre-ordered it will be in your hot little hands very soon. Here’s a little more about it for those who are new to the newsletter.

More than 500,000 Australians plan to retire in the next five years, preparing for the massive life change that signals their move from working every day to living as they choose. In the years before they retire, and the early years of retirement, people want to prepare well and set themselves up for the exciting journey ahead of them.

How to Have an Epic Retirement is filled with practical information, examples and questions covering the six key pillars of great modern retirement:

Time

Building your financial confidence

Looking after your health

Understanding how happiness is created and finding fulfilment

Living out your travel dreams

Your home and how your needs change in all the different phases of retirement

It’s the first book of its kind to explain in detail how the systems that support a new age and modern retirement in Australia work, making what can be a complex topic seem easy to navigate.

How to Have an Epic Retirement is written for you, Australia’s truly epic pre- and post retirees – so secure your copy using the pre-order discount below.

Out of the mouths of our community

This comment on the above article “How to manage retirement with a low super balance” is worth highlighting today. It helps put into perspective the enormous value you can find in pension concessions.

”I own my own home, am currently earning $6000 a year from term deposits, and receive the full aged pension. this brings my income to $33,000 a year. I get free registration for my car, a subsidy of $75 off my quarterly electricity bill, $27 off my quarterly gas bill. I only pay half council rates. My doctor bulk bills. I’ve never paid private health insurance. I don’t use my car much as I live in a transport hub and have a choice of bus, train or ferry for $2.50 an all of them for 24 hours.

I don’t need to buy as many clothes to go to work now and mostly dress casually. I go on cruises and other holidays. Meet friends for lunch and movies. In fact my life is not much different to when I was working except now my time is my own. Take heart readers, the amount you need to in retirement in this article is exaggerated. It’s like some people bemoaning $250,000 a year is not enough to live comfortably.”

Reply: Indeed we use the ASFA comfortable benchmarks to explain the cost of living in retirement because it is a helpful and well-benchmarked study of each individual line item in a retirement budget that is updated quarterly with inflation. But if you are smart with your money you can make it go further. Examples like this help us see how. Thanks for this detailed view.

Do you have other lessons you can share? Or questions you want answered? Send your learnings and thoughts to me on bec@epicretirement.com.au.

Join our Facebook Group here and be an active part of our conversations: Facebook.com/groups/epicretire

This week on social media

Instagram: It is estimated that around 40% of dementia cases are potentially preventable. Here’s six tips for doing so.

Retirement Dreaming/Epic Retirement Facebook Group: Join our big discussion on ‘If you could live anywhere in retirement - where would you live and why?’

Excellent reads from elsewhere

Each week I try to point to some terrific articles from across the internet. My hope is we build an ecosystem of storytelling that helps inspire us all to live longer healthier lives.

Can we maximise cognitive fitness: What I learned after 60 days playing Luminosity Brain Games, By Robyn Everingham, Age with Attitude

The puzzling gap between how old you are and how old you think you are, By Jennifer Senior, The Atlantic

Help me help you - take the quiz

What do you do for your financial planning services. Yesterday’s announcement by Anthony Albanese that he would support the move for superannuation funds to provide financial advice for their members is a massive shift of the ground. So I want to ask you today - where do get your financial advice?

Great info well explained. I will be back from London week after next and will check in for a chat.