Why you should think twice about retiring early

AND What should you ask your fund's financial adviser?

In this edition

Feature: What should you ask your fund's financial adviser?

SMH/The Age: Why you should think twice about retiring early

From Bec’s Desk: Inspired by you

Prime Time: Navigating a midlife identity crisis with Dr Julie Hannan

What should you ask your fund's financial adviser?

Helena asked, in The Epic Retirement Club Facebook Group, “I have an appointment with my financial planner from my fund this week. Can anyone give me some guidance on what questions I need to ask to make the most of my appointment?”

What an excellent question. I think you also need to ask, “What do I need to prepare before I visit to really get useful answers?”

Let’s look at both questions today.

Before you go and see your fund’s financial adviser, it’s a good idea to have three things prepared, otherwise you might find your appointment spends more time speaking hypothetically than you’d like:

A ‘big financial picture’ for your household. Think of this like a budget on steroids. I want you to document your assets, your liabilities, your income and your expenses. And I want you to be able to comfortably discuss your household’s ‘burn rate’, that is, how much money you need to spend every month and every year on your basic cost of living to be comfortable.

Your goals, written down. Yep, you need to start to build a picture of what you want your life to look like. If you don’t you’re really going to the adviser to ask ‘what’s possible’ and you might get a relatively canned response. I know I sound cynical, but I want you to be in the driving position of this appointment. So I want you to have thought about the destination you want to get to, before you jump into the car.

A review of your fund’s performance against benchmarks – comparing investment returns and fees. Don’t wait for your financial adviser (who probably works for your fund) to tell you how your investment choices are performing. Get out your statement and have a look. Compare your fund’s performance with the 3, 5 and 9 year performance of funds on the Your Super Comparison Website run by the government. That way you can ask questions with insight up your sleeve. And make sure you benchmark your fees against other funds in the same risk-level.

Then, once you’re in the appointment, here’s a helpful list of questions you can cherry-pick from, or even print out and use, to make sure you think of the things you want to discuss.

Read the rest of this article here

Why you should think twice about retiring early

Extract of article published in The Age, The Sydney Morning Herald, Brisbane Times, WA Today on Sunday 21st July 2024.

A lady named Lisa wrote to me this week, prepared for a big debate.

“I think you’re wrong about early retirement. I heard you say that retirement is not a 50-year-old’s project. I am planning to retire before 50 (along with my husband), and I can’t think of a better lifestyle where I’ll be responsible for my own time to spend with family, learning new things, exercising, travelling, volunteering and possibly working if I feel like it,” she said.

“I truly believe there is much more to life than the corporate 9 to 5 grind. I just don’t understand why anyone would say it’s a bad idea.”

I couldn’t resist probing. Lisa is 46 and hates her busy professional job. She told me that every Friday she feels excitement as the week comes to a close, then, on Sunday afternoon dread creeps in for the week ahead. Her three kids are in their mid and late teens. And she’s starting to reconsider her own sense of why.

Lisa’s situation is really, really common. She could change jobs, but she fears her industry is more of the same. So, at 46, the only light in the tunnel she and her husband can see is aiming hard for an early retirement and putting their foot to the floor trying to get there.

They’ve been saving one of their executive salaries almost fully for two years to reach for it. But I challenged her. Maybe she wants to embrace her prime time instead, and use that money as a buffer to reinvent herself.

Save like a young person planning to go to Europe for a gap year.

Most people like Lisa who aim for retirement in their forties or even early fifties find that when they get to early retirement, it isn’t what they are looking for at all.

They enjoy the first big holiday and maybe the first year or even two, where everything feels fresh and new, then, they look around and all the other 50-year-olds are busy and there’s no one to play with.

And while they’ve spent those years relaxing, overcoming burnout, they haven’t grown their knowledge, purpose and passions. They fill their time with travel to keep up the excitement and realise that travel is expensive if you do it constantly. Then they get bored, lonely, even a bit stale, and go looking for work.

The alternative is to recognise that they are in a classic midlife transition, at the bottom of what scientists call the U-curve of happiness that arrives commonly between the ages of 47 and 55. They could embrace it, recognising where they are at and working through the process of releasing their feelings of burnout and re-seeking their sense of purpose.

It might mean using some of their savings to take a midlife sabbatical, or even a gap year, investing in developing their skills and knowledge, spending time looking for things they are (or can get) passionate about and getting ready for this exciting next stage of their life. Not all of us need to have a midlife identity crisis to kick it off, but many of us do, without realising it.

The science of happiness says that many people feel a fundamental shift in their motivations in midlife.

First, our expectations of life change. We find we’ve achieved many of the goals we set for ourselves early in life (or we declare them unachievable or undesirable). Then we realise that the constant climb up the hierarchy of corporate life may not make us as happy any more, and we want to change gears and shift our goals towards our own happiness and fulfilment.

Read the rest of this article here on The Age, The Sydney Morning Herald, The Brisbane Times and WA Today. It also appears in the print editions today.

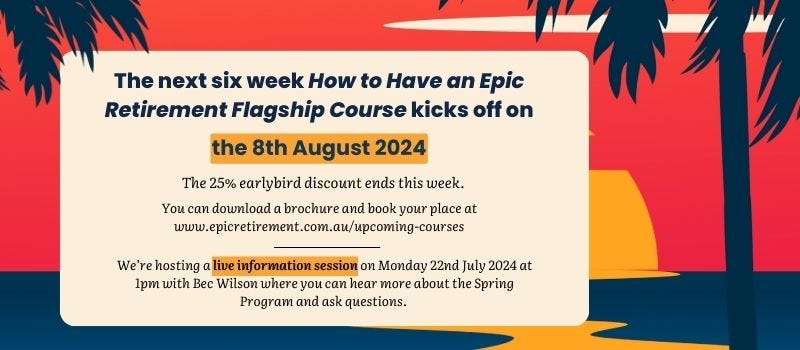

Our next How to Have an Epic Retirement Flagship Course is getting closer. It kicks off on the 8th August 2024. Earlybird bookings, which give you 25% off, close this week.

You can download a brochure here, with very detailed information about the speakers, dates for all our live Q&As and the content that we cover.

Or, just book your place here.

Come to a live information session about the Spring Program

I will, for the first time, be hosting a live information session on Monday 22nd July on Zoom, to run through what the course is covering, and give you the opportunity to ask any questions. The session will be short and sweet - running for about 15-20 minutes. Register here for the live information session.

I feel more inspired than ever reading your comments, questions and requests for how to navigate pre-retirement, as you can see in this week’s newsletter. Both stories I’ve written this week were inspired by our own community's letters, messages and conversations.

First, the letter from Lisa that I got Friday morning right when I was contemplating my newspaper column, really inspired me. And then, Helena in the ERC, who asked such a great question on Monday that I tucked it away for this newsletter. That really is what it’s all about. And both really are topics I’m covering in the book I’m fervently working on called Prime Time. So there’s so much more useful and functional information coming.

In other juicy topics, the Prime Time podcast newsletter this week had a poll on it that showed that about 75% of the people in our community has been through or is going through a midlife identity crisis! That’s big stuff. If that’s you, have a listen to the Prime Time podcast with Dr Julie Hannan. More on that below.

I have to say a big thanks. I was humbled this week when chatting with one of the super funds leaders they said one of their members had rung their fund and told them they’d done the course and read the book, and that they said everyone should. It’s so nice to know you are out there spreading the epic retirement word! If you are talking to your fund, don’t hesitate to tell them I sent you! They’ll know you’re well-informed and ready to plan properly! ☺️

Finally, as well as writing, I’ve been working on a new, fun project this week - swag! Fun and groovy t-shirts to brag about the epic retirement you’re living, or planning for. Watch this space. The designers are on it! I want them groovy, retro and fun.

I hope I see a few of you at the Wattle Partners event on Thursday in Sydney, remember, the Wattle Partners team has been kind enough to offer our Epic Retirement community free admission to the event if it interests you to come along. Here’s a link to the event website where you can register. The coupon code to use for your free pass is EPIC. Might see you there!

That’s enough for the week. Have a great week ahead. You can always email me at bec@epicretirement.com.au. Until next week… make it epic!

Many thanks! Bec Wilson

Author, podcaster, guest speaker, retirement educator … Visit my website for more info about me, here.

Ever wondered if you were having a midlife identity crisis? And if so, how you might navigate it and come out the other side a better version of you? In this episode, we delve into the intricacies of the midlife crisis with Dr. Julie Hannon, the author of "The Midlife Crisis Handbook”.

Dr. Hannon gives us a deeper understand of what a midlife identity crisis is, helping us understand it better and recognise it in ourselves. She talks about how it can manifest at any age, but is particularly relevant for those in their fifties and sixties and those moving into retirement. Then, she talks in-depth about how to help ourselves or a loved on who is struggling, using our values as a guide. It’s an interesting conversation for everyone who’s wondering how they might navigate their changing identity in the years ahead.

LISTEN TO THIS EPISODE OF THE PODCAST HERE: